More than 250 community members filled the Train Depot Thursday evening to ask questions and air concerns about the recent property assessments mailed earlier this month.

The August 8 meeting was initiated by Jack Lott, owner of Lott’s furniture, and the Downtown Merchant’s Association headed by Melissa Ingle.

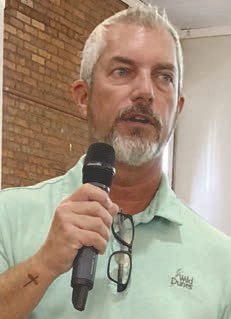

The Chamber of Commerce, Chaired by Bryan Hartley, stepped in to assist the DMA facilitate the meeting.

“Our involvement is to make sure the right information is getting out,” said Hartley. “We want to serve our businesses, our chamber members, our community. We want to make sure you’re heard today.”

Among the guests were business owners, residents, land tract owners, city and county commissioners, and city officials.

Tax Commissioner Roger Collins filled in for the absent Chief Tax Assessor Billy Carter.

“I’ve been in touch with Billy and he’s not able to make it tonight,” announced Hartley drawing loud spontaneous laughter from the crowd. “I will say in my conversation with him I feel like I saw his heart in what he’s trying to do and trying to make things right.

“I’d like our meeting tonight to be a meeting of Grace. Roger did show up saying, ‘I will step in. I‘ll be glad to talk about it and

© 2020 HEAD PUBLISHING, LLC.

explain how we got here.’ I think that should be very well respected, so let’s treat him with that appreciation for being here .”

Overall the audience maintained a sense of decorum with only a few people shouting caustic comments or speaking angrily out of turn.

Collins does not work for the Assessors Office nor do the assessors work for his office.

Although Collins painstakingly explained the timeline of how the county got where it is now beginning in 2012, the crux of the assessment problem appears to lie with the appraisals done by the outsourced appraisal company GMass.

Collins explained the county is required to have a reevaluation assessment every three years. In the past, one third of the parcels were evaluated each year over three years, meeting the requirement.

In 2014 the reevaluation cycle was broken.

“Business people, do you remember the personal property audit?” Collins asked. “That’s when it all stopped. Without throwing anybody under the bus, there were issues. It was not the assessors fault. They got hemmed up and it snowballed and it led to what you see here.”

The state mandated reevaluations be done in order to bring the county in line with assessments reflecting the increased real estate market. The deadline for the reevaluations was last year. The county filed for an extension for a cost of $10,000.

For each year the reevaluations are not completed the county is fined $104,950 per year ($5 per parcel) and $500 per business day.

In order to avoid the fines and appraise the 21,000 parcels in the county before the dead-line, the County Commissioners solicited bids for an outside company to assist with the appraisals. Only GMass bid the project and was consequently hired.

“Some of the parcels were appraised by the assessors themselves,” said Collins. “The majority of them were done by the company that was contracted.”

The company was paid $750,000 for the job by the county.

According to Collins, the time involved in hiring new assessors, training them and getting the appraisals done before the state’s deadline would have incurred fines in excess of $750,000.

Collins said when Chief Assessor Billy Carter viewed the file from GMass, “What caught his (Carter) eye was the commercial. He stopped and had to correct them. He noticed every commercial property went up a minimum of $2.5 million dollars. That’s the smallest mom and pop store to the biggest, a minimum of $2.5 million dollars a piece.”

A citizen responded, “If Carter found a problem with the commercial values, why did he not stop all of them and readjust? To me, you’re forcing the citizens of Ware County to have to file an appeal when it’s not their fault their assessment is wrong.

“This needs to be stopped,” the citizen coninued. “He should see what’s incorrect, get it corrected and roll it out.”

In response, Collins indicated the assessors cannot know which assessments are incorrect unless an appeal is made.

Collins reiterated several times during the meeting the importance of not only the appeal process, but also making the appeal within 45 days of receiving the assessment notice.

Collins emphatically stated the assessment notice is not a tax bill.

“The tax bill will not be created until the appeal process is completed and property values are ad-justed down and the millage rate roll back applied,” he said. “The taxes have not been set. The millage rates have not been set by the school board, the county or the city. They get that information from me.”

“You gave us a break last year, and now you want this money back?” asked another unidentified citizen.

Collins clarified the break seen on last year’s tax bills was from the State Homestead Relief Grant. Governor Brian Kemp used the grant to give money back to the tax payers.

“It was not a tax break,” responded Collins. “It was a one time deal from the Governor. Again, if you have a problem with your appraisal value, file an appeal.

“They have found issues with the appraisals from the file the company sent, but they cannot see what all the issues are unless you appeal.”

The meeting in its entirety can be viewed on the Chamber of Commerce website.

The Board of Assessors office is open 9-4 weekdays, until September 6. Appeals can also be filed online by entering Ware County qPublic in your search bar.

Select Ware County Tax Assessor’s Office, then Search records. Search your property by name, address or parcel number. Click Appeal to Board of Assessors and follow the prompts.

Bryan Hartley, Chairman of the WaycrossWare County Chamber of Commerce, served as the meeting’s moderator. Photo by EJ POND